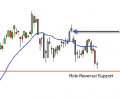

We already have a slightly bullish position in OIH through our Long Diagonal Calendar Call Spread. This cash secured put position will give us more of a profit should the stock rally to fill the gap up around the $43.50 level. If you have not yet taken a position with us in OIH then this is a good place to start. Selling a put allows you to collect a cash credit to your account as soon as the trade gets executed. The main point that I want to make is that this is considered to be a long position that exposes you to risk on the downside. Please be sure to review all of my notes at the bottom of the page so you are aware of the risk and prepared to manage that risk.